child tax credit portal update new baby

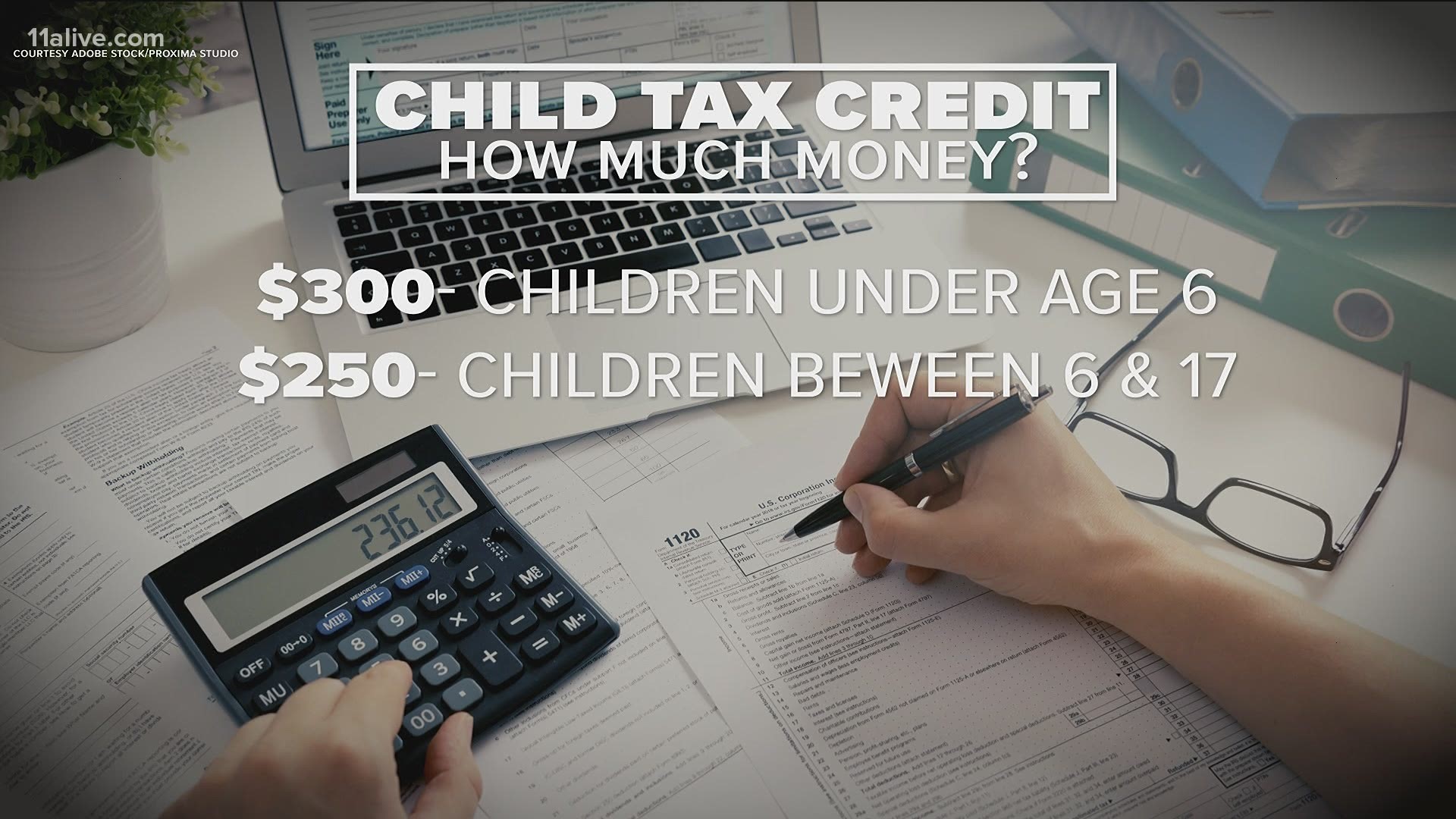

Now instead of 2000 parents can claim 3600 for children under the age of six and 3000 for kids between six and 17. Have been a US.

New Irs Update To Child Tax Credit Portal Allows Parents To Update Their Address Gobankingrates

In the meantime the expanded child tax credit and advance monthly payments system have expired.

. Heres How The Child Tax Credit Could Affect Your 2022 Taxes. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. Single or married and filing separately.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. This means that next year in 2022 the child tax credit amount will return. The IRS on Wednesday added a new feature to its Child Tax Credit Update Portal to allow individuals to update their bank account information in order to receive monthly advance.

This means that instead of receiving monthly payments of say. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The IRS has promised to launch two online tools by July 1.

The credit is divided by 12 with one-twelfth deposited. The update to the online portal allows families to quickly and easily update their mailing. Families who are expecting a baby to arrive this year can also claim the child tax credit cash.

The maximum child tax credit amount will decrease in 2022. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. One portal will allow.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the monthly checks. The American Rescue Plan which I was proud to support expanded the Child Tax Credit to provide up to 3600 for children under the age of 6 and 3000 for children under the.

To apply applicants should visit. Child Tax Credit Update Portal - get the latest info on 2023 2024 and 2025 GCM Car Release Date Price Redesign Photos Changes and Updates and Engine Specs.

Child Tax Credit Portal Coming Soon Um Offering Guidance On How To Claim Credit Mlive Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Irs Updates Child Tax Credit Direct Deposit Portal Gobankingrates

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How It Works Under The New Stimulus Bill

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Is Your Family Eligible For The Child Tax Credit Payments Legal Aid Of Nebraska

Child Tax Credit Update Portal Internal Revenue Service

Stimulus Update 5 Reasons Your October Child Tax Credit Payment Hasn T Arrived Yet

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Stimulus Payments For 2021 Babies How Does It Work 11alive Com

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

What You Need To Know About The Child Tax Credit The New York Times

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Comments

Post a Comment